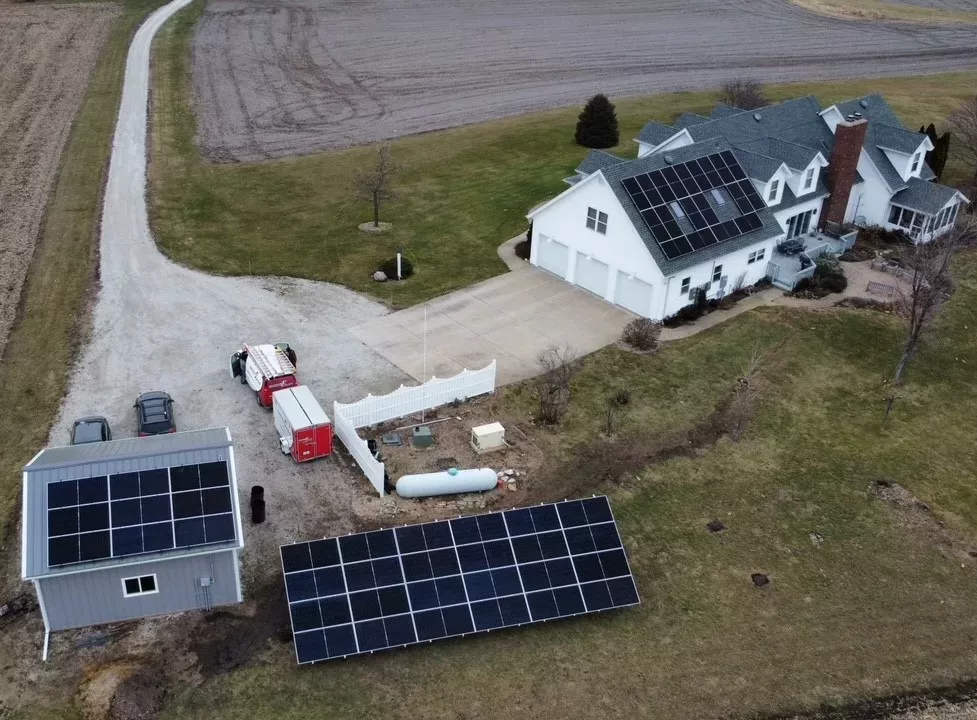

Solar Power for Homes

Save Money & Help Reduce Emissions

Keeping your family cool in the summer and warm in the winter has gotten more expensive in recent years — and even more so with ongoing inflation. As energy costs skyrocket, many Illinois homeowners are seeking alternative means of staying safe and comfortable. While residential solar panel installation carries many benefits, perhaps the biggest is that you will save on your electricity costs and reduce your carbon footprint.

Benefits of Solar

Homeowners are discovering Illinois is a great place to go solar because of the combinations of net metering, property tax exemption, and the federal tax credit.

Net Metering. Any excess solar power your panels produce is sent to your utility grid. Your utility company will then credit your account, further lowering your monthly bill. For example, Ameren customers may be eligible for a $300/kilowatt rebate through the company’s distributed generation program.

Property Tax Exemption. Solar panels are completely property tax exempt, so you can enjoy all the added value to your home without paying any extra in taxes

Federal Solar Tax Credit. The federal solar tax credit allows you to deduct 30% of the cost of solar installation from your federal taxes.

High Dependability, Low Maintenance. With our 30-year warranty covering the panels, microinverters, and installation, you don’t have to worry about what to do if something goes wrong. We go further than just the manufacturer’s warranty!

Given the limited time incentives offered by the state and federal governments, now is the best time to act on harnessing the power of the sun for your home!