Solar Power for Homes

Power Your Home for Less

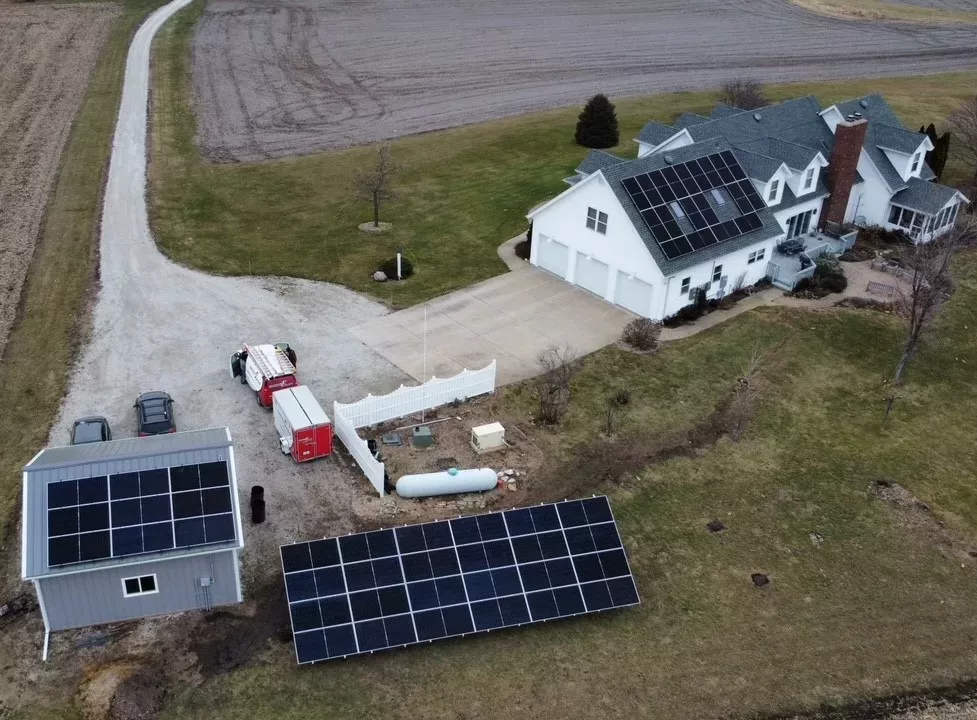

Keeping your home comfortable year-round is more expensive than ever, especially with rising utility rates and ongoing inflation. For many Illinois homeowners, solar energy offers a smart, long-term solution. By installing solar panels, you can significantly reduce your monthly electricity bills while lowering your household’s carbon footprint. It’s an investment that pays off in both savings and sustainability.

Benefits of Solar

Homeowners are discovering Illinois is a great place to go solar because of the combinations of net metering, property tax exemption, and the federal tax credit.

Net Metering. Any excess solar power your panels produce is sent to your utility grid. Your utility company will then credit your account, further lowering your monthly bill. For example, Ameren customers may be eligible for a $300/kilowatt rebate through the company’s distributed generation program.

Property Tax Exemption. Solar panels are completely property tax exempt, so you can enjoy all the added value to your home without paying any extra in taxes

Federal Solar Tax Credit. The federal solar tax credit allows you to deduct 30% of the cost of solar installation from your federal taxes.

High Dependability, Low Maintenance. With our 30-year warranty covering the panels, microinverters, and installation, you don’t have to worry about what to do if something goes wrong. We go further than just the manufacturer’s warranty!

Given the limited time incentives offered by the state and federal governments, now is the best time to act on harnessing the power of the sun for your home!

Residential Solar FAQ

- How much does it cost to install solar panels on my home?

The cost depends on your home’s energy usage, system size, and roof layout. Contact us directly at 309-444-0982 or fill out our form.

- Will solar really lower my electric bill?

Yes! In many cases, homeowners can reduce their monthly electric bills by 70% to 100%. With net metering, any extra energy you produce is credited back to your account.

- What is net metering?

Net metering allows you to send excess energy your solar panels produce back to the utility grid. You earn credits that reduce your future energy bills — maximizing your savings.

- How long do solar panels last?

Solar panels typically last 30 years or more. We include a 30-year warranty on the panels, microinverters, and installation — so you’re covered for decades.

- What if something goes wrong with the system?

Our systems are low-maintenance and very reliable. But if an issue ever arises, you’re protected by our comprehensive 30-year warranty and responsive support team.

- Are there any tax incentives available?

Yes! Homeowners are eligible for the 30% Federal Solar Investment Tax Credit (ITC). In Illinois, you may also qualify for net metering, property tax exemptions, and utility rebates.

- Will solar increase my property taxes?

No. Illinois offers a property tax exemption for solar systems, meaning your home’s value can go up, but your taxes will not.

- What if I sell my home after installing solar?

Solar panels can increase your home’s value and appeal to buyers. Studies show homes with solar often sell faster and for more than homes without.

- Will solar panels damage my roof?

We ensure every installation is done by certified professionals who preserve the integrity of your roof. In fact, solar panels can help protect the roofing material beneath them.

- Can I go solar if I have a shaded roof or limited space?

Our team will assess your property to determine the best solution. If your roof isn’t ideal, ground-mounted systems or partial offsets may still make solar worthwhile.